Rising DRAM Prices in Q1 2024: Analysis and Implications

The DRAM market is facing a significant shift as a new report from TrendForce projects a notable increase in prices for the first quarter of 2024. This analysis suggests that the best RAM options will become more expensive, with PC DRAM prices expected to rise by 10-15%. Additionally, similar increases are anticipated across other segments of the DRAM market, including Server DRAM and Graphics DRAM.

Detailed Price Predictions for Different DRAM Segments

The report indicates that the most substantial impact will be felt in the mobile market, with DRAM prices projected to rise by 18-23% over the same period. This trend reflects the broader market dynamics and the challenges facing different segments of the DRAM industry. The increase in prices is attributed to various factors, including market uncertainties and the transition period between DDR4 and DDR5 technologies.

Also check Crafting the Ultimate Gaming PC in 2024

Transition Between DDR4 and DDR5 Creating Market Uncertainty

One of the key factors contributing to the price increase is the ongoing transition between DDR4 and DDR5. This period of change is complicating manufacturer planning and contributing to market uncertainty. The report notes a significant buzz around unfilled DDR5 orders, indicating a demand and supply imbalance that is pushing prices upward.

Price Trends in Server and Graphics DRAM

Similar to PC DRAM, both Server DRAM and Graphics DRAM, like GDDR6, are expected to see price hikes in the first quarter of 2024. The report suggests that these increases will follow a similar scale to those predicted for PC DRAM, reflecting the broader trends across the DRAM market.

Mobile DRAM Facing the Steepest Price Increases

In the mobile DRAM segment, the predicted price increase of 18-23% is attributed to historically low prices leading to significant inventory building. This trend is expected to continue, pushing prices upward without deterring buying behavior for the time being.

Consumer DDR4 DRAM Market Also Affected

The report also forecasts a price increase in the Consumer DDR4 DRAM market, which includes memory chips for devices like smart TVs, consoles, and set-top boxes. These chips are expected to see a price rise of 10-15% in Q1 2024. However, the price rise for DDR3 used in Consumer DRAM is estimated to be slightly lower, at about 8-13%.

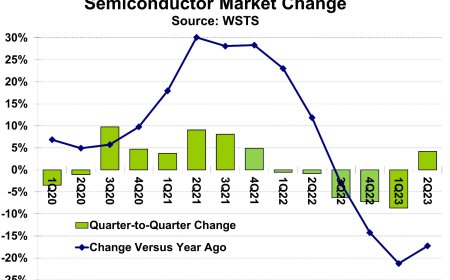

Historical Context and Future Outlook

Reflecting on past trends, DRAMeXchange had previously published figures showing a gradual rebound in DDR4 DRAM spot pricing since the summer. As of the report, the prices for 2x8GB DDR4-3200 are still below their January 2023 levels, but the market could soon see a return to the pricing levels observed at the start of 2023.

DRAM Manufacturers' Strategies and Market Risks

DRAM manufacturers have been strategically reducing output to influence prices. However, this approach carries risks, as competitors can introduce new, more cost-effective technologies or capitalize on market opportunities. Emerging competitors, particularly those based in China, might view the production cutbacks by established producers as an opportunity to gain market share.

Conclusion: The Changing Landscape of the DRAM Market

The forecasted rise in DRAM prices for the first quarter of 2024 indicates a dynamic and evolving market. The transitions between different DRAM technologies, coupled with strategic production adjustments by manufacturers, are reshaping the landscape of the DRAM industry. As the market navigates these changes, the impacts will be felt across various segments, from PC and Server DRAM to Graphics and Mobile DRAM. The DRAM market's future will be shaped by how manufacturers and consumers respond to these evolving trends and challenges.