The DRAM Market Dynamics: Q1 2024 Price Projections

In the ever-evolving landscape of DRAM (Dynamic Random-Access Memory), the pricing dynamics continue to undergo significant fluctuations. As we delve into the latest insights from TrendForce, it becomes apparent that the DRAM market is poised for another quarter of noteworthy price increases. In this in-depth analysis, we'll explore the projected price shifts across various DRAM segments, shedding light on the factors driving these changes and their potential implications.

Projected Price Increases: A Closer Look

TrendForce's latest report delivers projections that set the stage for price hikes in multiple DRAM categories. The most pertinent to our readers is the forecast for PC DRAM, which is expected to witness a substantial rise of 10-15% during the first quarter of 2024. This surge in contract prices reflects a broader trend of escalating DRAM costs that extends to Server DRAM and Graphics DRAM, both of which are also expected to experience price increases of a similar magnitude. However, it is the mobile DRAM market that will bear the brunt of these changes, with prices projected to surge by a staggering 18-23% within the same timeframe.

Also check SAMSUNG LAUNCHES ONE UI 6.0 UPDATE FOR THE GALAXY S22 SERIES

The Root Cause: Uncertainty in DRAM Demand

To comprehend the underlying factors driving these price projections, it is crucial to delve into the realm of uncertainty surrounding DRAM demand. TrendForce's report highlights that the primary catalyst for rising DRAM contract prices lies in this uncertainty. A more detailed examination reveals that the uncertainty revolves around the complex interplay between different types of DRAM, specifically DDR4 and DDR5. The industry is currently navigating a transitional phase, adding layers of intricacy to manufacturer planning and contributing to the pricing volatility.

PC DRAM: The DDR5 Conundrum

PC DRAM, a critical component for our readers, is facing the repercussions of this uncertainty. TrendForce notes that the PC DRAM market is witnessing a surge in unfilled DDR5 orders. This surge is intrinsically tied to the ongoing uncertainty regarding the balance between DDR4 and DDR5 demand and production. As the industry grapples with this delicate equilibrium, it provides fertile ground for price hikes in the PC DRAM segment.

Parallel Price Trends in Server and Graphics DRAM

Server DRAM, a cornerstone of data centers and enterprise computing, is not immune to the prevailing price surge. Q1 2024 is projected to usher in similar price hikes for Server DRAM, mirroring the dynamics seen in the PC DRAM market. Graphics DRAM, which plays a pivotal role in powering GPUs (Graphics Processing Units), follows suit with anticipated price increases, particularly for GDDR6 variants.

The Mobile DRAM Challenge

The mobile DRAM sector faces the most substantial price upheaval, with expectations of an 18-23% price increase in the first quarter of 2024. Historically, low prices in this segment have led to inventory buildup. Surprisingly, this accumulation of inventory has not deterred buyers but has instead fueled further price escalations.

Consumer DDR4 and DDR3 DRAM: A Mixed Bag

For Consumer DDR4 DRAM, utilized in a range of consumer devices such as smart TVs, gaming consoles, and set-top boxes, the first quarter of 2024 is anticipated to bring about price rises in the range of 10-15%. Conversely, DDR3 DRAM, another variant used for consumer applications, is expected to experience comparatively modest price increases in the range of 8-13%.

Reflecting on Past Trends

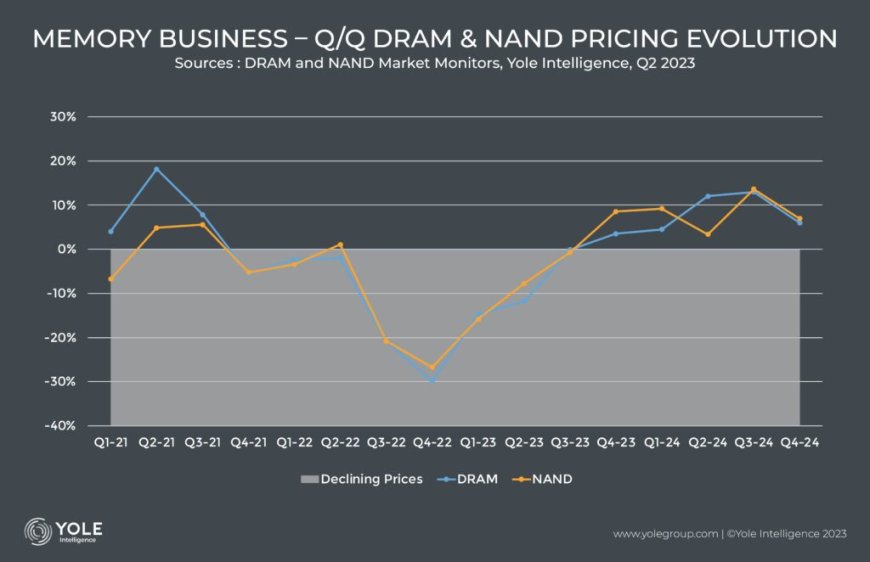

As we assess the current DRAM landscape, it's worth reflecting on past trends. Notably, DDR4 DRAM spot pricing has exhibited a gradual rebound since the summer. At present, prices for 2x8GB DDR4-3200 memory modules remain approximately 17% lower than January 2023 levels. This trend suggests a potential return to DRAM pricing levels reminiscent of early 2023.

The DRAM Industry's Complex Game

Behind the scenes, DRAM manufacturers have strategically reduced production output throughout 2023, or possibly longer, in a bid to drive prices upward. However, this maneuver carries inherent risks. Rival DRAM manufacturers can introduce innovative technologies to make bit production more cost-effective, ultimately boosting demand. Additionally, emerging competitors, particularly those based in China, perceive the restraint of established producers as a golden opportunity to enter the market.

Conclusion: Navigating DRAM Price Volatility

In conclusion, the DRAM market remains a dynamic and unpredictable arena, marked by continuous price fluctuations. The projections for Q1 2024 indicate a period of price escalation across various DRAM categories, with implications for PC users, server infrastructure, graphics processing, mobile devices, and consumer electronics. The underlying uncertainty surrounding DDR4 and DDR5 demand, coupled with inventory dynamics, plays a pivotal role in driving these price shifts. As the DRAM industry navigates this intricate landscape, it must strike a delicate balance between supply, demand, and innovation to sustain growth and competitiveness.